The Department of Education yesterday imposed massive sanctions on for-profit college chain ITT Tech, giving the predatory college thirty days to place $153 million in escrow to protect students and taxpayers from potential costs associated with the company’s malfeasance. At the same time, the Department banned ITT from enrolling new students using federal financial aid money.

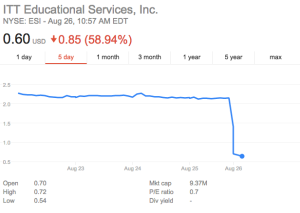

ITT’s stock fell 35% in half an hour after yesterday’s announcement before trading was halted to stop the slide. It opened down another 50% this morning, leaving the total stock value of the company at less than ten million dollars.

ITT’s stock fell 35% in half an hour after yesterday’s announcement before trading was halted to stop the slide. It opened down another 50% this morning, leaving the total stock value of the company at less than ten million dollars.

This is almost certainly the end of the road for ITT Tech, until recently one of the biggest players in the for-profit college world. The company has little hope of raising the cash it needs to provide the funds the Department has demanded, particularly given its dependence on federal financial aid for revenue — last year 80% of its income came from Department-administered financial aid programs. (Adding to ITT’s woes, the escrow requirement puts the company in violation of the terms of a $100 million loan it received from a private equity firm in 2014. Oops.)

The Department’s crackdown on ITT is a welcome, if overdue, development. For years, the D0E has allowed the chain to operate with near-impunity as it defrauded students and flouted federal regulations, and yesterday’s actions represent a decisive — and potentially historic — break with that history.

In a particularly heartening move, the Department imposed a wide variety of sanctions on ITT, each designed to ensure that the company, its management, and its investors are held accountable for ITT’s misdeeds. In addition to the escrow requirement and the ban on extension of financial aid to new enrollees, the department:

- Mandated notice to current ITT students that the institution is in violation of accreditation requirements.

- Forbade ITT from issuing any “bonuses, severance payments, raises, or retention payments to any of its Management or Directors.”

- Prohibited ITT from paying dividends to its investors.

Each of these sanctions, as it happens, are ones that Chris Hicks of the AFT and I urged the Department to impose on predatory for-profit colleges in our June report, Regulating Too-Big-to-Fail Education: Next Steps for the Department of Education.

For too long, the Department of Education has failed to act aggressively in using its oversight and enforcement powers to rein in for-profit education companies that prey on students and divert taxpayer money to programs that offer little or no benefit to enrollees. The Department’s decisive action against ITT yesterday gives reason for hope that the entire for-profit sector will soon be subjected to the kind of robust, common-sense regulation that it so desperately needs.

Leave a comment

Comments feed for this article